69Finance resume examples found

All examples are written by certified resume experts, and free for personal use. Copy any of the Finance resume examples to your own resume, or use one of our free downloadable Word templates. We recommend using these Finance resume examples as inspiration only, while creating your own resume.

Learn more about: how to write a perfect resume

Performed financial transactions including receiving checks and cash for deposit to savings and checking accounts, verifying deposit amounts, examining checks for endorsement and negotiability. Ensure compliance with security and regulation procedures for the protection of cash and other assets.

Challenging position providing comprehensive assistance to bank customers whilst supporting corporate goals.

Recruited to undertake due diligence and restore company profitability, involving considerable improvements to finance, HR, payroll, and legal operations. Managed product initiatives including sourcing, contracting and designing business models and break-even analyses.

Multifaceted role requiring analytical and relations expertise to efficiently evaluate and explore investment opportunities.

Focused position requiring great attention to detail and project management expertise to successfully manage accounting processes and facilitate business objectives.

Oversaw the day-to-day financial activities including accounts payable, accounts receivable, and payroll. Established financial policies and procedures; managed financial reporting and monitoring compliance. Debt refinanced $1.7M to secure more favorable contract terms. Sourced funding by presenting a 3-year income model, business plan, and performance analysis to prospective equity investors, commercial banks, and leasing companies.

Promoted Allstate Insurance products and services in all endeavors by utilizing up-selling and innovative sales strategies. Advised clients on various asset protection insurance coverage options and utilizes an expert consultative selling approach with clients; known as a trusted advisor. Collaborates with external partners and the local community for referrals. Serves as a liaison between the agency and community to promote insurance products and services. Provides training to new hires on all products, services, sales, and computer systems.

Managed automobile insurance including motorcycle, RV, ATV, boat, and Mobile Home claims as part of special lines team across the state. Examined damages, evaluated practicality of repair versus replacement, prepare estimates; enter claim payments and new claims on a computer system.

Provided investment opportunities for Fortune 500 corporations, governments, and some of the world’s most affluent investors. Fostered relationships at the topmost levels while charting and executing value-driven transactions. Business and Market Impact.

Evaluated financial metrics of various corporations and provided result-driven solutions to executives on strategic initiatives.

Banking

Personable and enthusiastic professional with experience in sales and customer relations positions. Adept at managing high-profile client accounts and establishing strong business relationships which result in an overall increase in revenue and the attainment of defined corporate goals.

Financial analyst

Accomplished Senior Financial Analyst, offering in-depth knowledge and extensive experience in directing and advising on all aspects of complex financial and accounting processes. Effectively utilizes various financial techniques to analyze financial data, recommend tools, systems, and accounting measures to drive profitable performance. Offers leadership experience with the interpersonal skills needed to build strong relationships. Thrives in fast-paced environments requiring the ability to prioritize and manage multiple projects within time limits.

Finance manager

Methodical finance manager with 6+ years’ professional experience in successfully growing clients’ revenue streams through strategic financial plans and project management. Offering expertise in evaluating business performance, developing detailed financial reports and competition analysis, and cash flow management in support of corporate and individual clients.

Insurance

Customer oriented and analytical insurance agent, recognized for skills in sourcing and singing up new clients for policies. Leveraging previous sales and customer service expertise to evaluate each prospective clients’ need and recommend policies suited to them whilst providing them with ample information on insurance premiums, coverages, and claims information.

Financial advisor

Client-focused financial and banking professional, offering 12+ years of verifiable experience in financial services and client services operations with leading banking institutions. Equipped with both entrepreneurial and intrapreneurial leadership to drive top/ bottom-line growth. Utilizes excellent communication skills to develop a relationship with cross-functional business partners and key internal and external stakeholders. Implements cutting-edge solutions that foster improved processes, sound credit policies, and profitability.

Banking

Resourceful Banking professional, well versed in the workings of the financial market and customer care to successfully manage a portfolio of consisting of high income clients. Seeking a challenging position at a reputable financial institution that allows for further career growth.

Financial analyst

A highly astute, energetic, and team-spirited financial analyst graduate seeking a position to meet and exceed an organization’s goals and objectives. Adept at working as part of a cross-functional team or independently. Communicates effectively with all levels of an organization.

Finance manager

Analytical and results oriented finance manager, adept at streamlining daily financial operations whilst translating complex data into actionable information to achieve strategic organizational goals. Looking to join an advanced organization that allows for further career growth and exposure.

Insurance

Goal-focused insurance agent, recognized for leveraging previous sales and customer service expertise to consistently surpass set sales goals. Looking to build a successful career within an ambitious organization, whilst honing new skills to better execute duties and bring value to clients.

Financial advisor

Dynamic Financial Advisor, adept at efficiently evaluating clients’ assets whilst educating them on different financial and investment products to develop comprehensive financial plans that facilitate the attainment of their financial goals. Looking to join an ambitious financial institution to raise client satisfaction and facilitate strategic financial plans.

Make a resume that wins you interviews! Choose one of these professionally-designed resume templates and follow 3 easy steps to complete.

Create a perfect resume in a few minutes

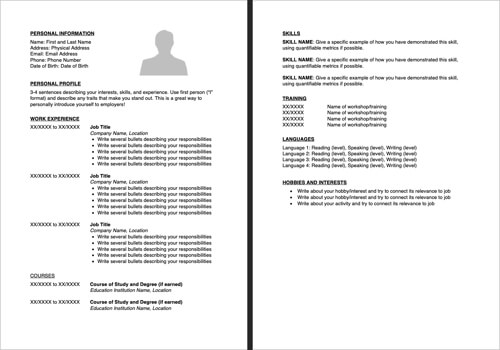

Download our American style resume template. Chronological resume format. Download a functional resume template.

Learn more about the differences between a resume and a CV.

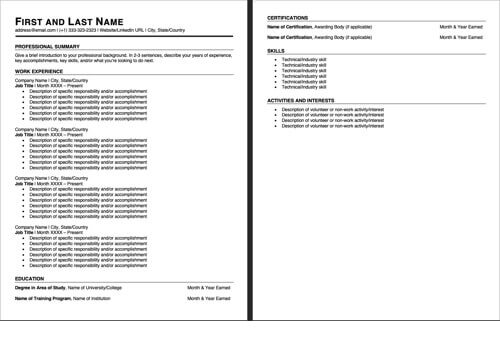

Download our British/European style cv template. Similar to a resume but more commonly used in Europe, Asia and Africa.