16Financial analyst resume examples found

All examples are written by certified resume experts, and free for personal use. Copy any of the Financial analyst resume examples to your own resume, or use one of our free downloadable Word templates. We recommend using these Financial analyst resume examples as inspiration only, while creating your own resume.

Learn more about: how to write a perfect resume

Developed strong end-to-end knowledge of the investment and consultancy industry within the company’s structure and through exposure to various functions within Tier 1 and Tier 2 financial organizations. Established relationships with stakeholders from a wide business network and portfolio.

Multifaceted role requiring analytical and relations expertise to efficiently evaluate and explore investment opportunities.

Conducted regular credit valuations on unsecured loan requests, provided an outcome in line with the company's credit policy, guidelines, and lending benchmarks while working meticulously with internal and external investors.

Recruited to undertake due diligence and restore company profitability, involving considerable improvements to finance, HR, payroll, and legal operations. Managed product initiatives including sourcing, contracting and designing business models and break-even analyses.

Complex, data-intensive role, requiring financial research, analytical and relations expertise to build a valuable network of key industry players to promptly harness insights to build portfolios.

Conducted quantifiable examinations of prospective clients for lines of credit. Evaluated collateral values in processing requests and then formulated written credit-approval packages or denial memos.

Directed general accounting, finance, and budgetary control, maintenance of fiscal records, and preparation of financial, sales, and operational reports. Presented accounting and financial statement and analysis data to the executive team and recommended improvements.

Performed technical due diligence for $1B+ acquisitions and effectively recommended post-merger action, modeled integration costs, an appropriate mix of investments, potential risks, and opportunities using technical accounting expertise and researcher and executive interviewer skills to determine growth trends, quality net assets, financial statement analysis, and cash flows for Fortune 100 clients. Collaborated with Technology, Risk, and advisory teams on Private Equity projects.

Managed a $25 million credit portfolio. Collaborated with clients to acquire necessary collateral, cultivate strong relationships, and maximize additional credit opportunities. Administered credit policies have proven to minimize losses and grow sales. Established credit lines, controlled bad debt levels across the portfolio, and mitigated risk with proprietary finance alternatives. Proactively addressed necessary credit resolutions.

Conducted data analysis of the company’s operational business and processes under the supervision and direction of the senior risk analytics manager. Worked on several high-impact projects daily, tasked with controlling costs, forecasting income, and improving key processes.

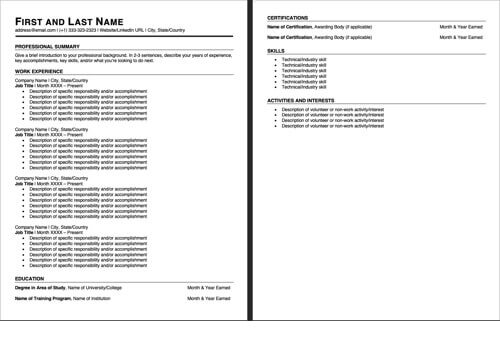

Make a resume that wins you interviews! Choose one of these professionally-designed resume templates and follow 3 easy steps to complete.

Create a perfect resume in a few minutes

Download our American style resume template. Chronological resume format. Download a functional resume template.

Learn more about the differences between a resume and a CV.

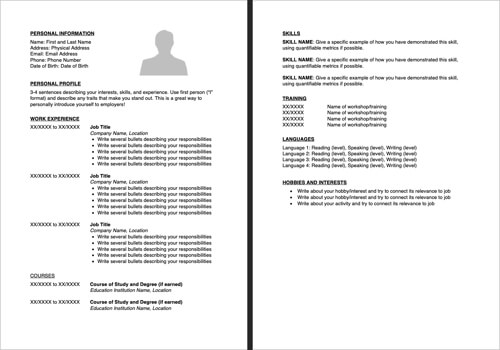

Download our British/European style cv template. Similar to a resume but more commonly used in Europe, Asia and Africa.