32Accountant resume examples found

All examples are written by certified resume experts, and free for personal use. Copy any of the Accountant resume examples to your own resume, or use one of our free downloadable Word templates. We recommend using these Accountant resume examples as inspiration only, while creating your own resume.

Learn more about: how to write a perfect resume

Provided leadership in the coordination of efforts that ensure smooth, timely, and accurate financial information and profitable performance. Managed all domestic and international finance and accounting. Oversee all financial statements, budgeting, cash accounting, account analysis, and monthly global consolidating management reporting and analysis. Serve as a key advisor to execute leadership and supervise a team of 7.

Decreased company overpayments by 20% via audit processes and process improvement initiatives. Developed and implemented streamlined review and authentication procedure to support accounting department.

Promoted within 5 months of hire to the highly responsible role of overseeing accounts receivable for three business units across the USA. Managed invoicing, billing, collections, cash/credit transactions for world-class beverage companies’ while delivering excellent customer service.

Multifaceted role requiring relations expertise to maintain multiple functional working relationships with stakeholders and team mates.

Performed monthly Earned Value Metric tasks including cost risk analysis and assessment, visibility reports, Work Breakdown Structure development, budgeting, and forecasting. Prepared operating monthly Business Unit Review financial charts to board utilizing, MPM, SAP, COGNOS, MS Excel/PowerPoint.

Provided professional tax management and advisory services to a wide range of individuals and organizations such as charities, small businesses, trusts, and non-profit organizations. Ensured all the organizations comply with audits and adhere to government regulations, grant requirements, Federal acquisitions Regulations, per Generally Accepted Government Auditing Standards(GAGAS), and GAAS.

Centralized tax guidance process for companies, partnerships, and individual investors; conducted interviews and answered tax consultation inquiries, prepared complex income tax returns, and file adjustments to state returns for review. Secure confidential tax difference records, tax return papers, and investigates material discrepancies between tax returns and end-of-period tax accounting records. Composed and audited business property declarations, business license tax, property tax, gross receipts, excise tax, and state business license registrations.

Detail-intensive position requiring precision and sharp analytical skills in the execution of duties.

Guided accounts payable department of 6 including 4 offshore team members, to complete targeted AR/AP tasks such as general ledger maintenance, accruals, rate analysis, monthly financial accounts, invoices, account reconciliation, P&L statements, and financial reports. Manage freight accrual planning with a budget of $1M monthly. Streamlined Account Payable process by reducing accruals; migrated construction and industrial division’s freight data into the White Cap corporate database.

Developed and implemented streamlined processing workflow to reduce time costs and opportunities for human error. Partnered with leadership to revise daily operations and integrate improved processing guidelines.

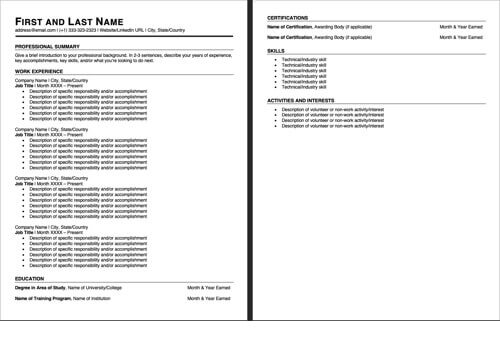

Make a resume that wins you interviews! Choose one of these professionally-designed resume templates and follow 3 easy steps to complete.

Create a perfect resume in a few minutes

Download our American style resume template. Chronological resume format. Download a functional resume template.

Learn more about the differences between a resume and a CV.

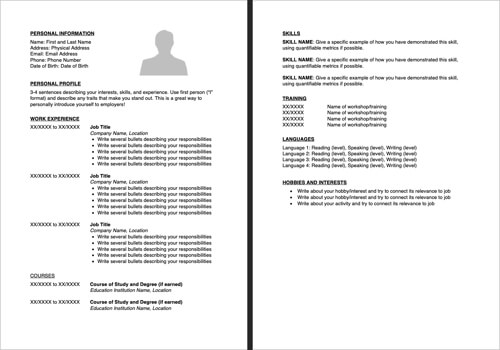

Download our British/European style cv template. Similar to a resume but more commonly used in Europe, Asia and Africa.