28Banking resume examples found

All examples are written by certified resume experts, and free for personal use. Copy any of the Banking resume examples to your own resume, or use one of our free downloadable Word templates. We recommend using these Banking resume examples as inspiration only, while creating your own resume.

Learn more about: how to write a perfect resume

While in college, took on a part-time position as a cashier for a local grocery store.

Performed financial transactions including receiving checks and cash for deposit to savings and checking accounts, verifying deposit amounts, examining checks for endorsement and negotiability. Ensure compliance with security and regulation procedures for the protection of cash and other assets.

Generated $1 M deposits in one year. Developed a relationship and sales plan for a diverse customer base. Provided a broad range of services including portfolio management, investment management, and credit and personal banking products.

Oversaw $5+ billion investment portfolio of complex fixed-income instruments including Collateralized Mortgage Obligations, Mortgage-Backed Securities, Asset-Backed Securities Hybrid ARMs, Corporate Debt, and Money Market Instruments. Established strategic initiatives to enhance liquidity, profitability while complying with asset/liability management objectives. Educated senior management regarding portfolio management and liquidity.

Multifaceted role requiring critical thinking and relations management skills to support seamless financial processes.

Oversaw a variety of Loan Servicing functions including Commercial, Real Estate, and Consumer loans. Processed final closing and distribution of paid loans and payoff demand statements. Guided lenders and staff regarding documentation, commercial loan booking, and underwriting compiled and stored credit and collateral files as per state, federal, and banking regulations. Analyzed loan data, documentation, and calculations per GAAP standards; identified risks and recommended policies /procedures to correct deficiencies and improve performance.

Challenging position providing comprehensive assistance to bank customers whilst supporting corporate goals.

Provided account services to customers by receiving deposits and loan payments, cashing checks, issuing savings withdrawals, recording night and mail deposits, and selling cashier's checks, answering customer questions, and referring to other bank services. Ensured compliance with bank operations and security procedures by participating in all dual-control functions.

Responsible for a portfolio of 20 million and achieved a growth of 2 million monthly through cross-selling bank products encompassing Individual Accounts, Personal Loans, Credit Cards, etc.

Provided personal, customized, financial counsel and wealth management services for an established full-service investment firm. Managed and retained full-service investment relationships for over 400 clients; provided and administered investment portfolio management, financial planning, wealth management, custodial, trust, and brokerage accounts, and retirement and 401K planning.

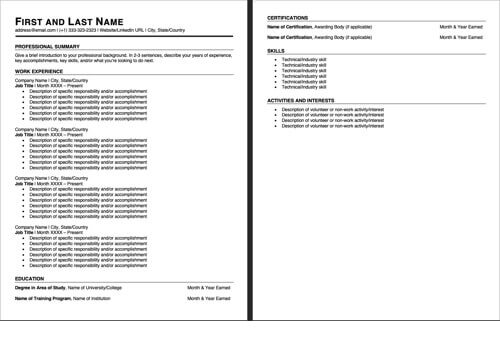

Make a resume that wins you interviews! Choose one of these professionally-designed resume templates and follow 3 easy steps to complete.

Create a perfect resume in a few minutes

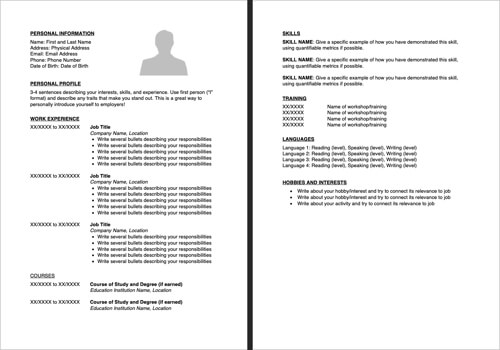

Download our American style resume template. Chronological resume format. Download a functional resume template.

Learn more about the differences between a resume and a CV.

Download our British/European style cv template. Similar to a resume but more commonly used in Europe, Asia and Africa.